How we do it

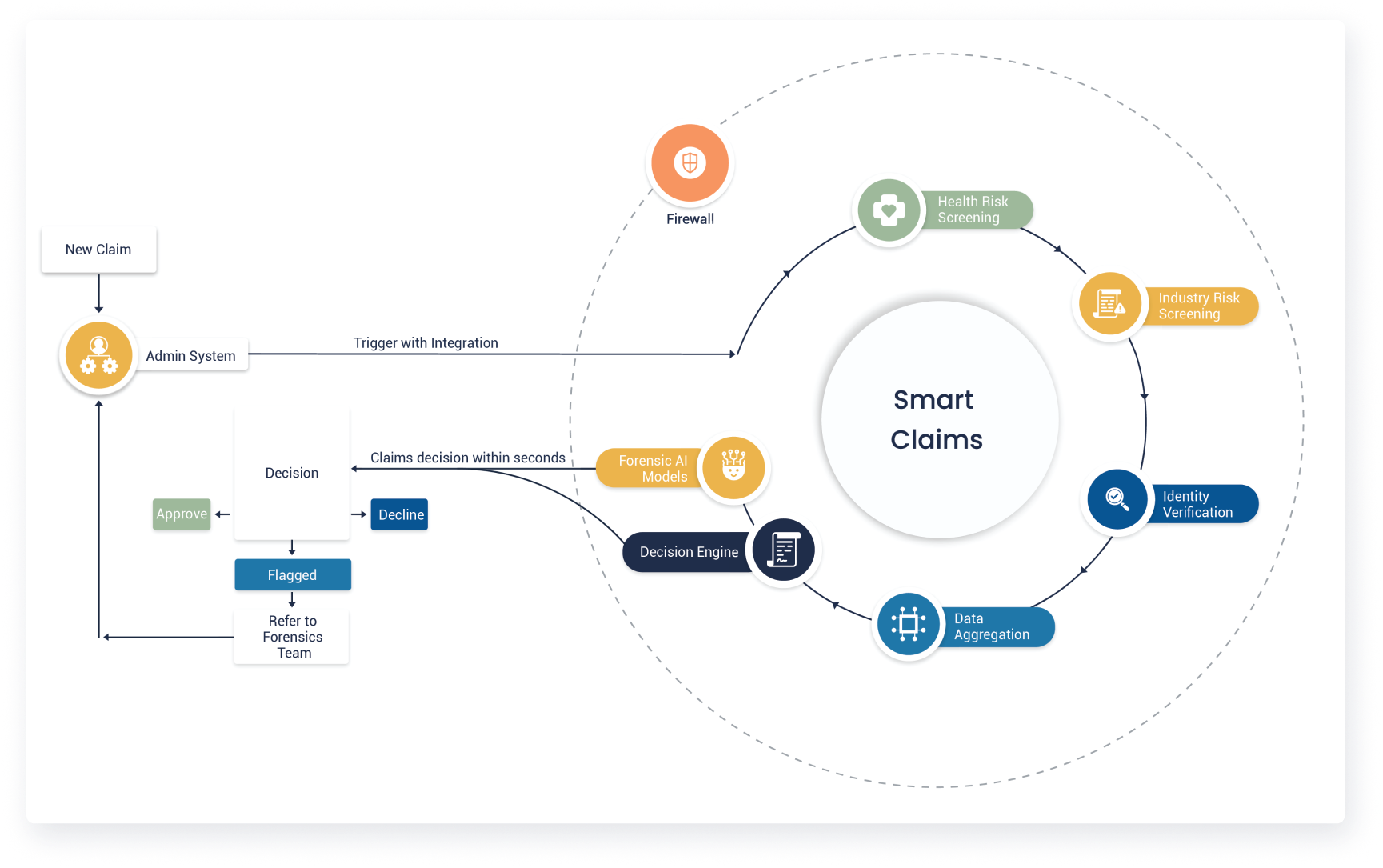

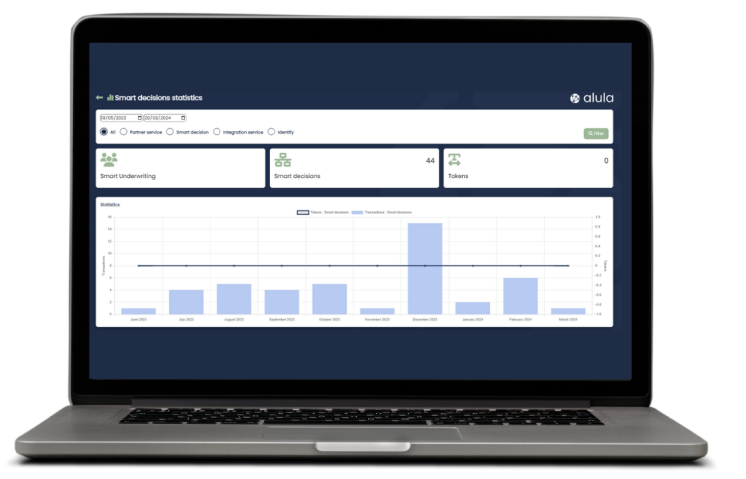

The Smart Claim solution processes incoming data, supplemented by additional information from integrated services, and applies business-configured rules to deliver outcomes. These outcomes can either initiate straight-through-processing or provide enhanced data for your claims team’s review.

The system also incorporates AI digital twins to automate complex, unstructured decisions, insuring real-time efficiency and scalability. With capabilities for bulk testing and rule comparison, the platform not only enhances processing speed and accuracy but also maintains rigorous audit trails for complete transparency.