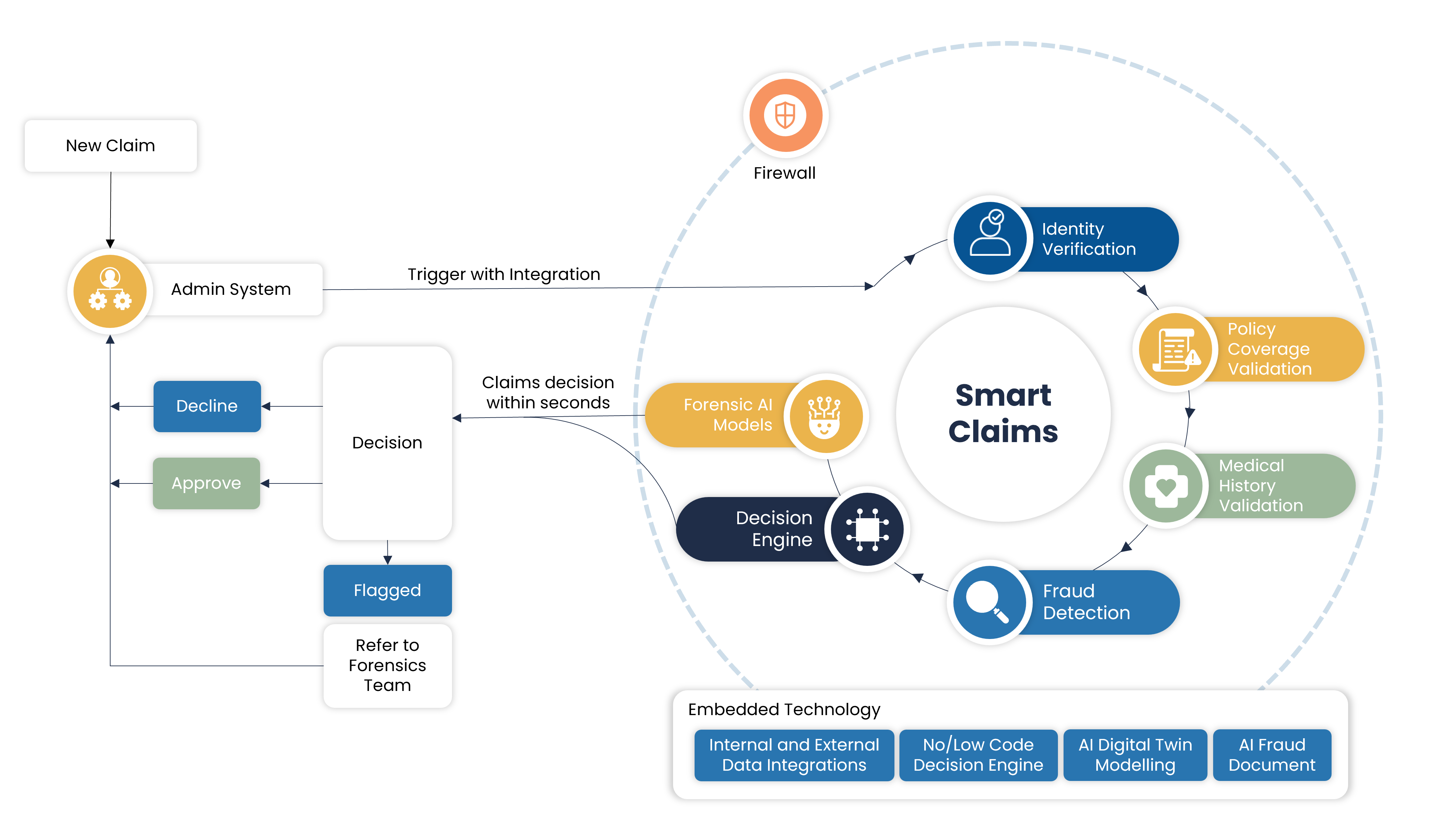

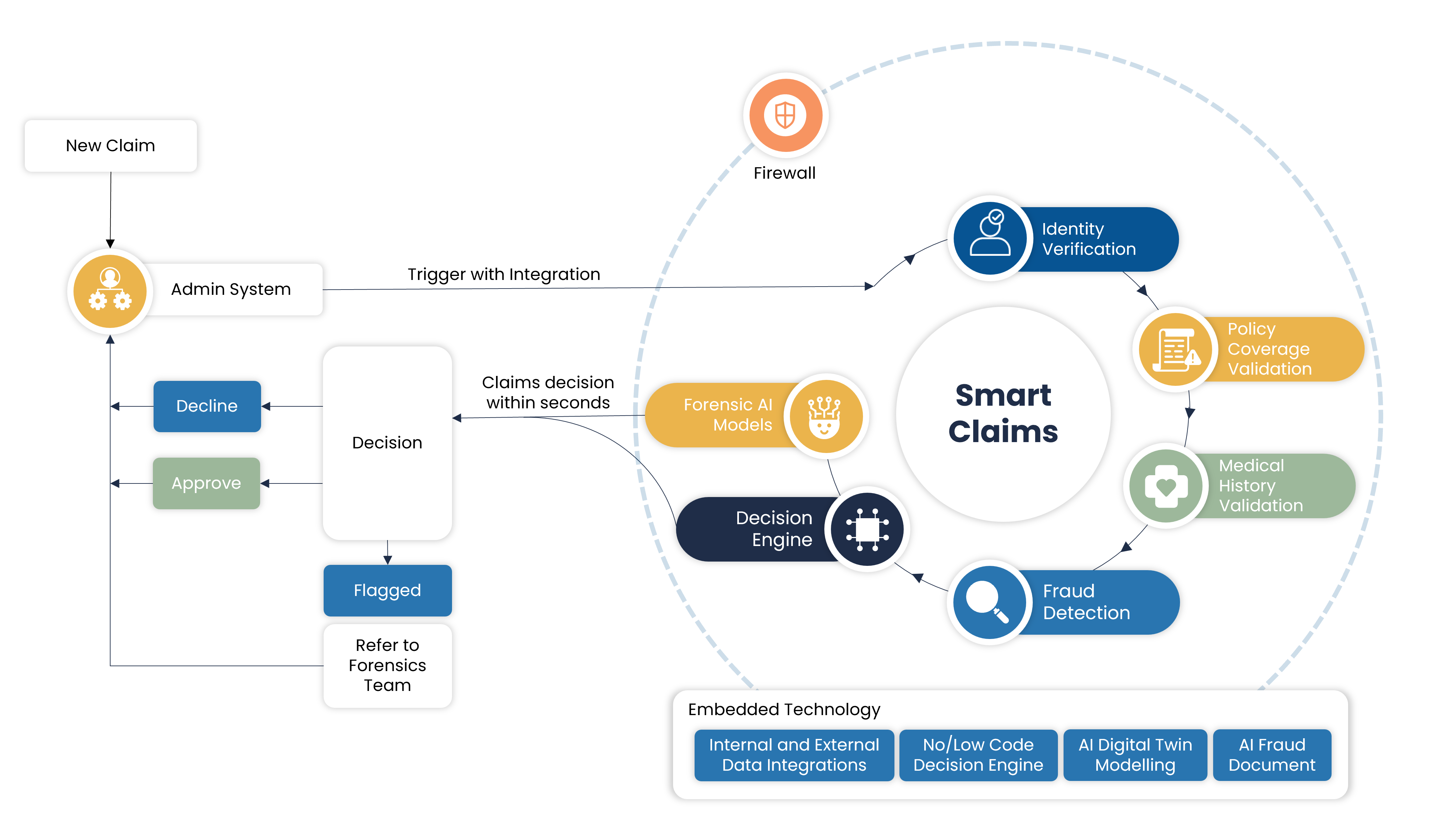

Alula’s Smart Claims is an innovative insurance claim verification solution enriched with Artificial Intelligence (AI). This advanced system empowers a real-time, fully automated claims processing experience, eliminating the need for manual intervention by claims processing staff

Integrate real-time internal and external data to enrich claims decisions. Seamlessly integrate with your existing claims landscape, enhancing operational agility.

Reduce operational costs and improve efficiency with our automated, no-code tools and AI integration. Enable your business to build and maintain robust decision-making frameworks, ensuring consistent and reliable outcomes.

Mitigate fraud, risk, and abuse by enabling Digital Twin AI models of experts and comprehensive audit trails. Ensure compliance with evolving regulations through automated compliance checks using our no/low code decision engine, reducing regulatory risks and penalties.

Increase customer satisfaction with faster, more accurate, consistent, and transparent adjudication, verification, and settlement processes.

The Smart Claim solution processes incoming data, supplemented by additional information from integrated services, and applies business-configured rules to deliver outcomes. These outcomes can either initiate straight-through-processing or provide enhanced data for your claims team’s review. The system also incorporates AI digital twins to automate complex, unstructured decisions, insuring real-time efficiency and scalability. With capabilities for bulk testing and rule comparison, the platform not only enhances processing speed and accuracy but also maintains rigorous audit trails for complete transparency.

Automated Claims Evaluation

Easy to use Decision-Making Frameworks

No/Low Code Claims Decisioning Engine

Seamless Integration with Internal & External Data

Real-Time Analytics and Reporting

Efficient Claims Processing

Claims Settlement Optimisation

Enhanced Customer Experience

Improved Risk Assessment

Effective Fraud Detection

Introducing Alula’s Smart Claims:

Smart Claims Demo: