How we do it

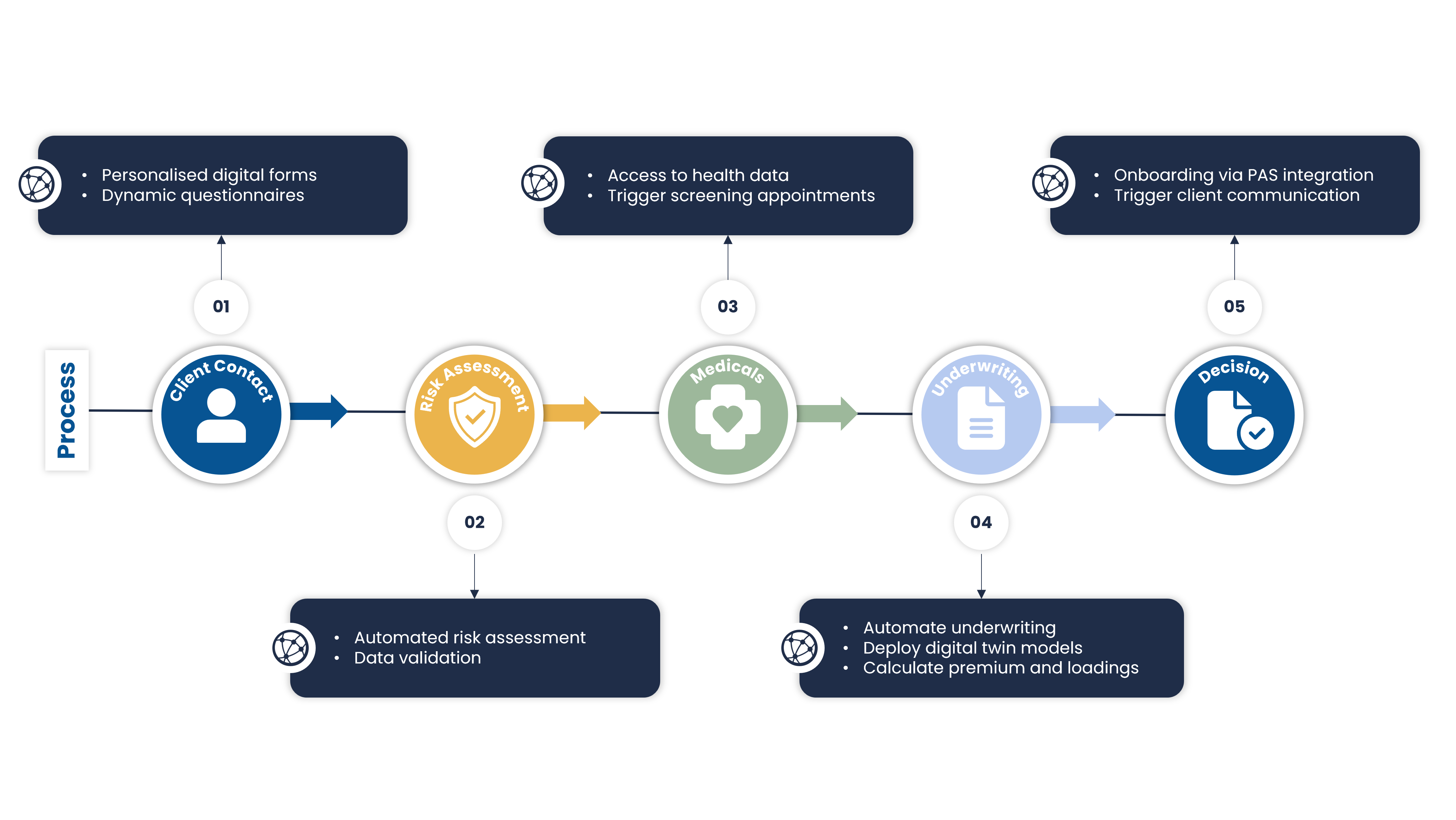

The below flow diagram provides a visual representation of the Smart Underwriting process, showcasing its dual impact of enhancing process speed and reducing costs tied to the collection of individual patient-centred data. This innovative, AI-driven system harnesses real-time insights from expert underwriters within the business, seamlessly incorporating them into both new insurance applications and existing policies.

Smart underwriting process